Post by Ethan / JRyan on Aug 17, 2018 22:18:35 GMT -5

Meged oil field

Givot Olam Oil Exploration - Limited Partnership (1993) (GOOXF)

Other OTC - Other OTC Delayed Price. Currency in USD

Market Cap (intraday) 5 198.7M ( I think in Israeli monies not US $)

Total Cash (mrq) 1.95M

Avg Vol (3 month) 15.38k

Avg Vol (10 day) 14.43k

Shares Outstanding 10.57B

Float 9.83B

Yahoo share price link

Now if one was asking what happened, they should be looking at the 10 Billion shares issued, yeah that is a "B". That is a real problem when raising more funds. It took them a while but they did hit commercial oil.

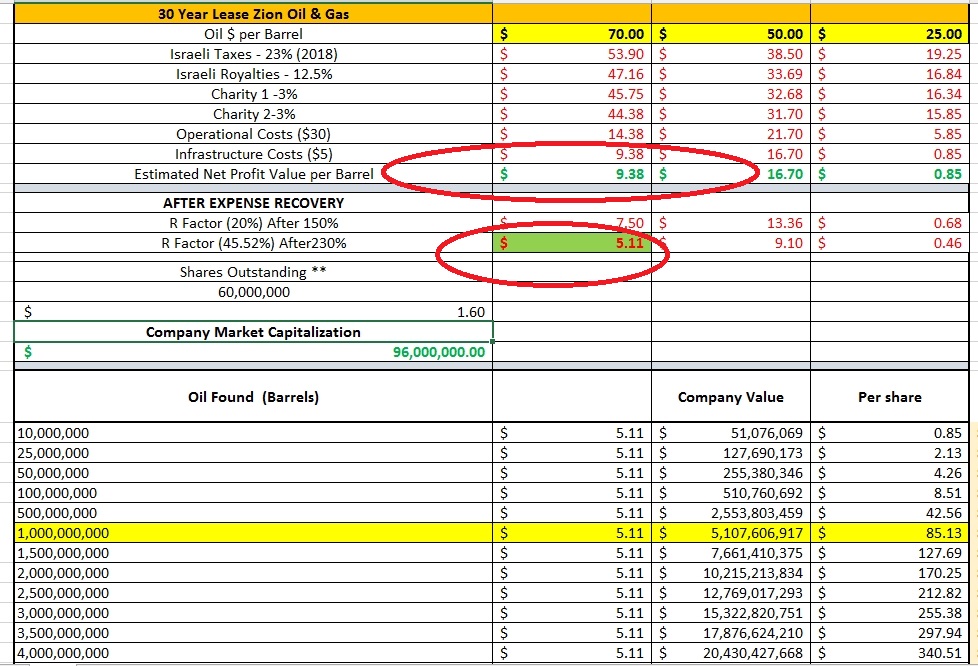

Here, take a look, the math works! Go figure.

Of course that was not enough to make up for the share dilution.

Seems that 50 Million barrels will put ZN around $9 a share before PE ratios are included. What happens if it's more? See what Givot said in 2004.

May 05, 2004 12:00 AM

Sep 22, 2010 1:08 AM

Givot Admits: We Can't Estimate Scope of Oil Reserves at Meged-5

11 Apr, 2018 16:21

Givot Olam oil exploration license deadline extended

25 Jun, 2018 15:25

Petroleum Commissioner takes back Givot Olam licenses

Of course we have been told from the short and distort crowd there is no oil, Givot must have found Olive Oil or something?

Givot information

Givot Olam Website

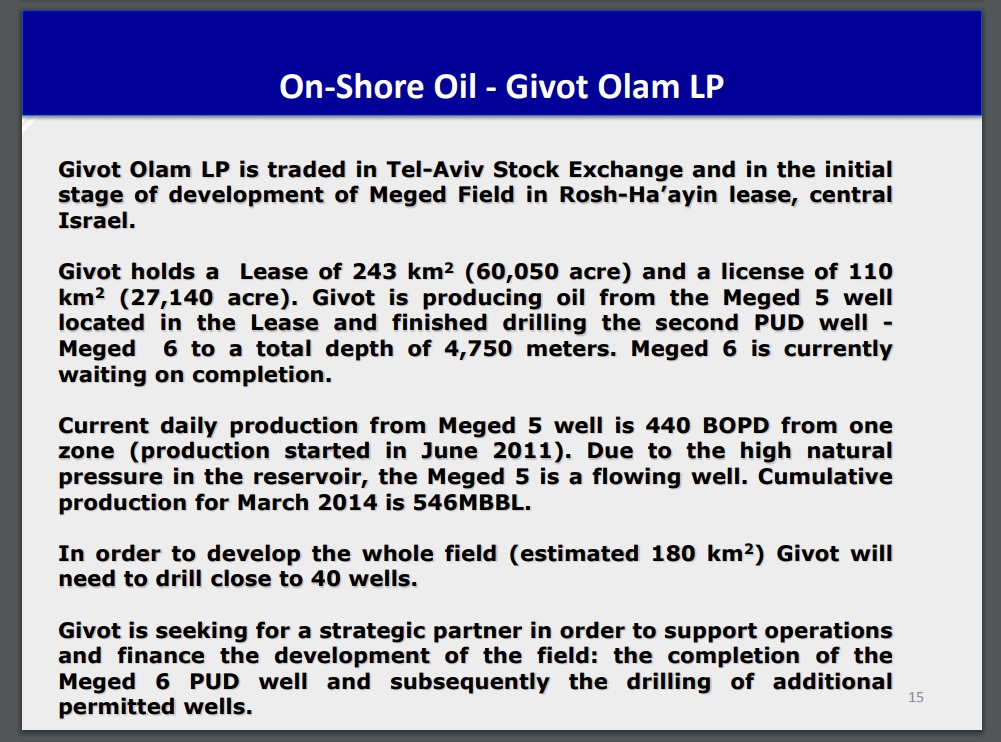

In 2004 the Meged oil field was recognized as an oil discovery by the Ministry of National Infrastructures, Energy and Water. Givot Olam partnership was awarded a lease for the development of the oil field and for production of oil from it: the Rosh Ha’Ayin Lease I/11. The lease is 243 square kilometers in size, and is valid until 1.4.2032, with the option of extending the lease for an additional 20 years. The Givot Olam Partnership has a 99% holding in this lease.

Givot Olam Oil Exploration - Limited Partnership (1993) (GOOXF)

Other OTC - Other OTC Delayed Price. Currency in USD

Market Cap (intraday) 5 198.7M ( I think in Israeli monies not US $)

Total Cash (mrq) 1.95M

Avg Vol (3 month) 15.38k

Avg Vol (10 day) 14.43k

Shares Outstanding 10.57B

Float 9.83B

Yahoo share price link

Now if one was asking what happened, they should be looking at the 10 Billion shares issued, yeah that is a "B". That is a real problem when raising more funds. It took them a while but they did hit commercial oil.

Here, take a look, the math works! Go figure.

In 2009 the Meged 5 well was drilled and commercial quantities of high quality crude oil (API 39-40) were produced. Production started in 2011 and continues until today. Cumulative production from Meged 5 is 700,611 barrels (approx. 110,681 m3) as of 31.03.2015.

Meged 5 site

The Meged 5 well, located in the South-Eastern portion of the Rosh Ha'Ayin Lease I/11was drilled in 2009 to a depth of 4700m.

With the completion of drilling, the well was stimulated to enhance deliverability of the hydrocarbons from the reservoir via natural fractures.

Meged 5 well draws from a hydrocarbon bearing reservoir composed of 8 zones. The deepest zone, Zone 1, is at a depth of 4700m, and the shallowest zone, Zone 8 is at a depth of 4000m.

Meged 5 well has been producing continuously and commercially since June 2011, and is in the long-term testing phase. Currently Meged 5 is producing from just one zone, Zone 8b. The production rate was initially 800 barrels per day, and has been declining to the current rate of 400 barrels per day.

The oil is produced to the surface continuously and automatically, and continues over Shabbat and Holidays, in accordance with Rabbinic authorization of Rabbi Adin Shteinsaltz Shlita and the Tzomet Institute

The Meged 5 well, located in the South-Eastern portion of the Rosh Ha'Ayin Lease I/11was drilled in 2009 to a depth of 4700m.

With the completion of drilling, the well was stimulated to enhance deliverability of the hydrocarbons from the reservoir via natural fractures.

Meged 5 well draws from a hydrocarbon bearing reservoir composed of 8 zones. The deepest zone, Zone 1, is at a depth of 4700m, and the shallowest zone, Zone 8 is at a depth of 4000m.

Meged 5 well has been producing continuously and commercially since June 2011, and is in the long-term testing phase. Currently Meged 5 is producing from just one zone, Zone 8b. The production rate was initially 800 barrels per day, and has been declining to the current rate of 400 barrels per day.

The oil is produced to the surface continuously and automatically, and continues over Shabbat and Holidays, in accordance with Rabbinic authorization of Rabbi Adin Shteinsaltz Shlita and the Tzomet Institute

Of course that was not enough to make up for the share dilution.

Givot Admits: We Can't Estimate Scope of Oil Reserves at Meged-5 Production test disappoints investors with only 44 million barrels of oil reported, and no word on how much of this will be economically feasible to pump.

Seems that 50 Million barrels will put ZN around $9 a share before PE ratios are included. What happens if it's more? See what Givot said in 2004.

May 05, 2004 12:00 AM

There could be a reservoir of 980 million barrels of oil at the Meged-4 well northeast of Kfar Sava, exploration company Givot Olam said yesterday, reporting geological findings to the Tel Aviv Stock Exchange

Givot Olam Reports $6 Billion Oil Reservoir Near Kfar Sava

There could be a reservoir of 980 million barrels of oil at the Meged-4 well northeast of Kfar Sava, exploration company Givot Olam said yesterday, reporting geological findings to the Tel Aviv Stock Exchange.

Amiram Cohen

Givot Olam Reports $6 Billion Oil Reservoir Near Kfar Sava

There could be a reservoir of 980 million barrels of oil at the Meged-4 well northeast of Kfar Sava, exploration company Givot Olam said yesterday, reporting geological findings to the Tel Aviv Stock Exchange.

Amiram Cohen

The report showed the production test to be disappointing, with only 44 million barrels of oil. And Givot Olam couldn't say how much of this will be economically feasible to pump - the key information investors want.

Energy analyst Yaron Zar of Clal Finance said: "On first sight, the engineering report released by Givot is poor. The report points out that in Meged-5 it will be possible, in a best-case scenario, to produce about 13 million barrels of oil.

Sep 22, 2010 1:08 AM

Givot Admits: We Can't Estimate Scope of Oil Reserves at Meged-5

11 Apr, 2018 16:21

Givot Olam oil exploration license deadline extended

25 Jun, 2018 15:25

Petroleum Commissioner takes back Givot Olam licenses

The Givot Olam partnership obtained the Rosh HaAyin prospect in April 2002, but has since conducted only three drillings: Meged 4, which included a side drilling and a horizontal drilling; Meged 5, which was drilled twice in the same place; and Meged 6, which also included a side drilling. Only Meged 5 produced oil, and oil production was completely discontinued in April 2017.

The oil potential in the Meged field is estimated in the hundreds of millions of barrels, but Givot Olam, which held drillings there in recent years (up until April 2017), managed to produce only relatively small quantities from it. Givot Olam began producing oil from the Meged 5 field in 2011 and had produced just over one million barrels by the end of 2016, most of which were sold for $84 million. At the same time, for most this time, the partnership suffered losses, among other things because of production malfunctions and investment in development of Meged 6. Eventually, the partnership ran out of money and discontinued its activity.

Of course we have been told from the short and distort crowd there is no oil, Givot must have found Olive Oil or something?

Givot information

Givot Olam Website

.jpg)