Theory - The Bakken,Eagle Ford, Permian Basin - & Zion Oil?

Aug 30, 2018 19:36:40 GMT -5

ratbike1000r, ccrc79, and 5 more like this

Post by Ethan / JRyan on Aug 30, 2018 19:36:40 GMT -5

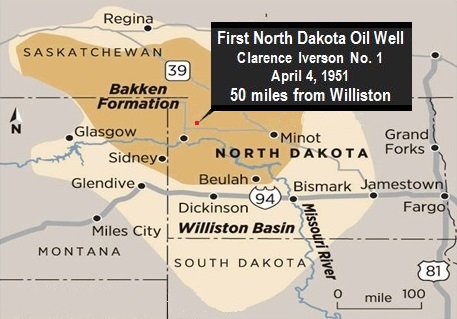

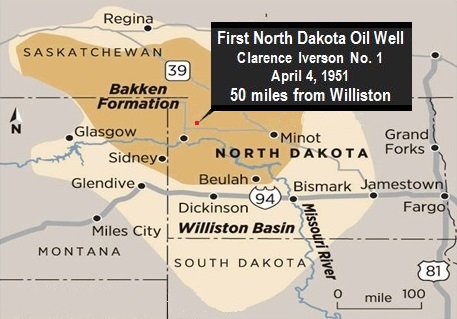

OK I will start with the following information about the Bakken (Williston Basin) formation in the Northern US. This is not new, but a very old and well known formation. It dates from the 1950's.

Now let these numbers sink in a minute..

Wow, now before one gets excited as that is more than Saudi Arabia or darn near it. Today those estimates are lower but its the details that grab you when you read between the lines.

Case and point,

Notice the word, and it is an important one. It states "technically" recoverable in 2008. Now this is the same organization that states there are 2 billion barrels in the Levant Basin (where Zion is).

In 2011 it was around the same size.

Now with the rise in technology, that same organization now says this in 2013:

Notice that technology is changing very quickly, notice the rig count and the barrels per day per rig. technology in this field is expanding at a very quick pace.

The price to drill and operate these wells is dropping quickly. When the Saudis opened the valves to flood the world with cheap oil, it was their and the US Administrations goal to bankrupt the shale play. It backfired in ways that no one could have seen in late 2011. The costs to get the shale oil went from around $75 a barrel, same as the Alberta sands down to around $35 barrel today and the price keeps dropping.

So how much oil is produced in these wells? Its hundreds of barrels a day on average.

Bakken Formation

So what does this have to do with Zion Oil? Well I will get to that in a bit but for now I need to present my case.

Move over ExxonMobil, Chevron and ConocoPhillips—there's a new "Big Three" in U.S. energy production. And they're not companies.

That 90%! Think about that a minute. Nearly 1/3 of US oil production is from just 3 shale formations!

It a revolution in technology that is changing the energy landscape around the world! I wonder where the other shale oil production is coming from?

Now a kicker is the following statement,

Elite oil fields redefine meaning of crude's 'Big Three'

That is huge!

Here is another article on the mighty Bakken formation.

The Mighty Bakken

To think that it was known in the 1950's but the technology did not exist. The very first oil well in North Dakota gave hints of what was to come 60 years later.

First North Dakota Oil Well

Here is another article that explains this transformation of oil drilling technologies that changed the face of oil production forever. Its a PDF so save it if you like.

Oil Production from the Bakken Formation: A Short History

As I asked earlier, if the big three are 1/3, then were are the others coming from?

What I was really after was the actual well production, and that is exactly what I found!

EIA.Gov - Drilling Productivity Report by Region

So what does this mean to Zion Oil and Israel? Well let's hold on a minute. Costs are very prohibitive to make a well commercial and I have shown above these costs are dropping very fast in the US but Israel is an unknown at this point.

In the US these well cost somewhere around $5-10 million on average but it is falling.

April 7, 2016

The Current Costs for Drilling a Shale Well

Also there is the possibility of re-fracking a well at 75% cost savings as the technology gets better.

Re-fracking Old Wells Is Extending the Fracking Revolution

I was reading the following article at lunch and decided I would dig into it when I get home and that is why this thread is here. I will continue to research it because it is important for not only the US but Israel as well.

As I have stated, the previous administration had done their best to kill the shale oil industry and without allowing new pipelines it got worse. There was nowhere to send the oil to without large costs. Mr. Buffet and his railroads were doing just fine however.

We now are building the pipelines and infrastructure we need to get the oil out and to market. The Keystone pipeline being one big one that the previous Administration kept stopping. Yes it was mainly for the Tar Sands but passed right through the Williston Basin as well.

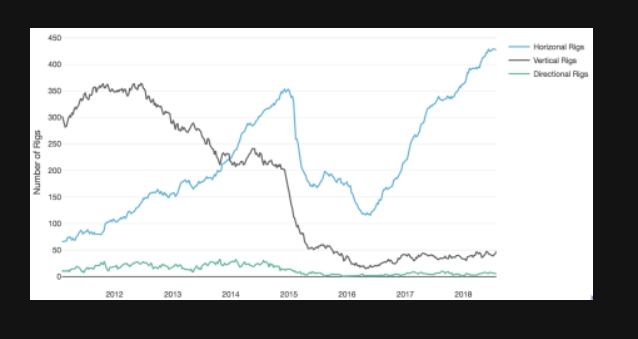

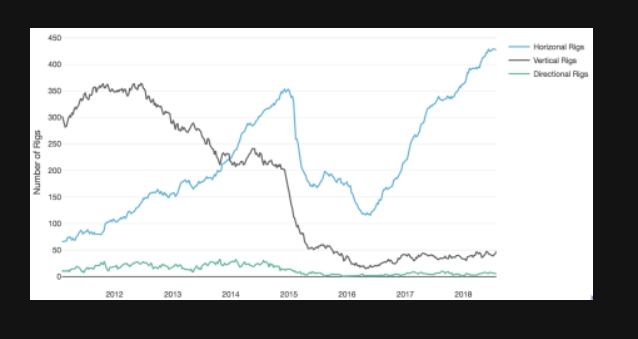

The type of wells is also changing rather quickly, lateral wells are becoming the norm.

August 30, 2018

Production Growth In The Permian To Hit New Record

So again, what does this have to do with Zion Oil? Well we are almost there..

Major Shale Find Could Guarantee Israel’s Oil Supply For Years

Notice what the article title is? Yeah that is starting to make sense now.

Notice where Genie drilled? MJ#1 location?

Why stop and go away? Environmentalists I think are playing a part in it as well as politics.

Israel Oil Discovery: Massive Reserve Could Meet Domestic Demand, But Obstacles To Production Lie Ahead

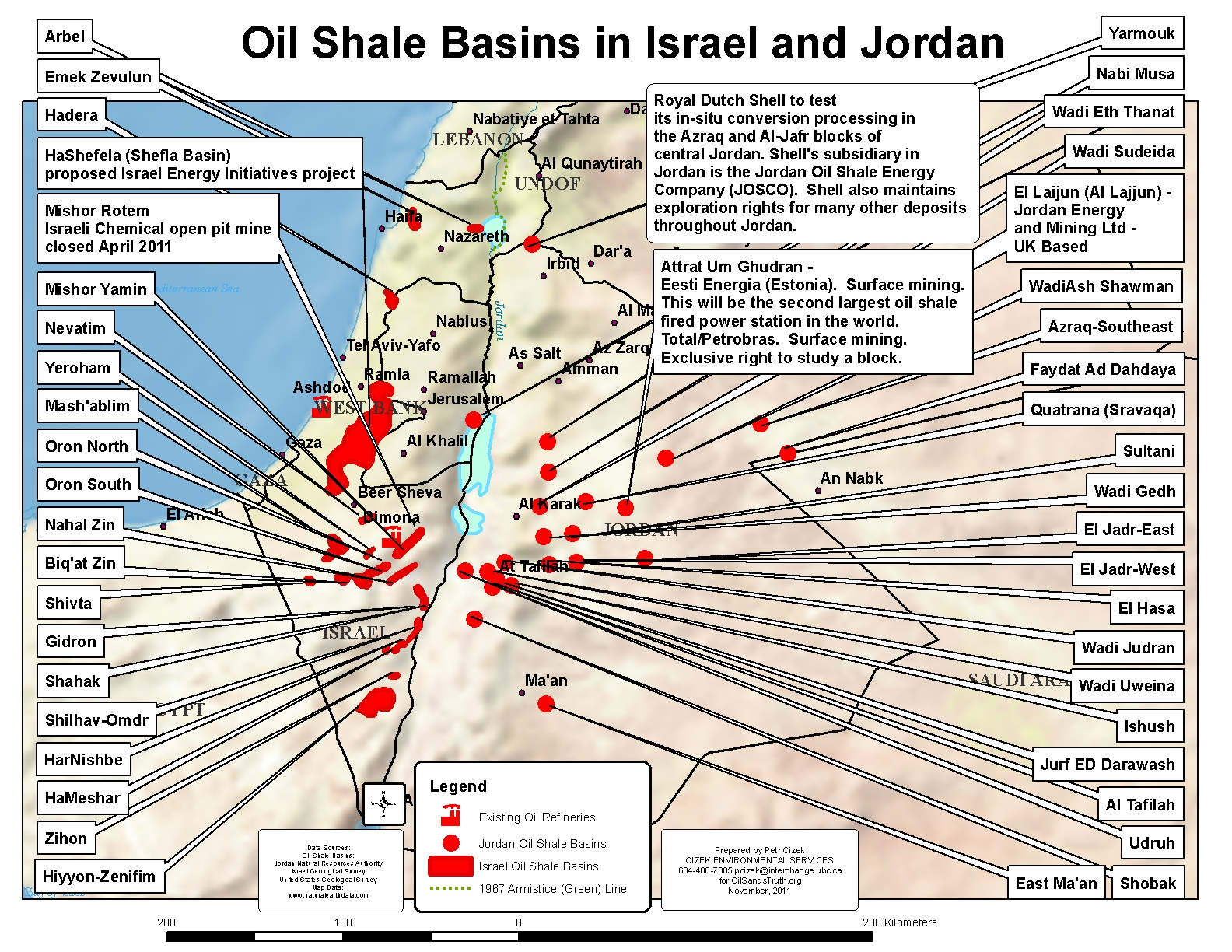

Oil Shales in Israel

And here is Genie again, right in the middle of it.

Is Israel The Saudi Arabia Of Shale Oil?

Israel / Palestine Shale Oil

This is not just an Israeli thing, its all over folks!

World distribution of Oil Shale

So finally I get to my point. What if Zion has hit a formation deep in the Triassic with low permeability but with large amounts of oil in place but it is not conventional? What would be the the percentage recoverable and with what technology? What if this testing is just that, getting a good feel for how to get the oil out. Givot did it, so there is history already in place. Genie, while shallower, also hit massive amounts of oil but claimed it was not economical to get to out just as North Dakota was in 1950. Technology is changing so fast that this remains a serious possibility.

MJ#1 sure was not a blowout like a spindle top, but something is amiss somewhere. How can they be testing this long if it does not naturally flow? What are they doing to entice it to flow? What is it that they know and are not telling anyone yet? I would think with Zion's previous record and their great relationship with the Israeli petroleum commission, they might be doing just that. I mean they could not announce it at this point as the Environmentalists will go crazy as this is not the Golan, the political situation is far different.

Levant Basin Reserves

Besides the Bakken formation being a widespread prolific source rock for oil when thermally mature, significant producible oil reserves exist within the rock unit itself.[4] Oil was first discovered within the Bakken in 1951, but past efforts to produce it have faced technical difficulties.

Now let these numbers sink in a minute..

Oil in place

A research paper by USGS geochemist Leigh Price in 1999 estimated the total amount of oil contained in the Bakken shale ranged from 271 to 503 billion barrels (4.31×1010 to 8.00×1010 m3), with a mean of 413 billion barrels

A research paper by USGS geochemist Leigh Price in 1999 estimated the total amount of oil contained in the Bakken shale ranged from 271 to 503 billion barrels (4.31×1010 to 8.00×1010 m3), with a mean of 413 billion barrels

Wow, now before one gets excited as that is more than Saudi Arabia or darn near it. Today those estimates are lower but its the details that grab you when you read between the lines.

Case and point,

In April 2008 the USGS released this report, which estimated the amount of technically recoverable, undiscovered oil in the Bakken formation at 3.0 to 4.3 billion barrels (480,000,000 to 680,000,000 m3), with a mean of 3.65 billion.[5] Later that month, the state of North Dakota's report[6] estimated that of the 167 billion barrels (2.66×1010 m3) of oil in place in the North Dakota portion of the Bakken, 2.1 billion barrels (330,000,000 m3) were technically recoverable with current technology.

Notice the word, and it is an important one. It states "technically" recoverable in 2008. Now this is the same organization that states there are 2 billion barrels in the Levant Basin (where Zion is).

In 2011 it was around the same size.

The US EIA reported that proved reserves in the Bakken/Three Forks were 2.00 billion barrels of oil as of 2011

Now with the rise in technology, that same organization now says this in 2013:

An April 2013 estimate by the USGS projects that 7.4 billion barrels (1.18×109 m3) of undiscovered oil can be recovered from the Bakken and Three Forks formations and 6.7 trillion cubic feet of natural gas and 530 million barrels of natural gas liquids using current technology.[

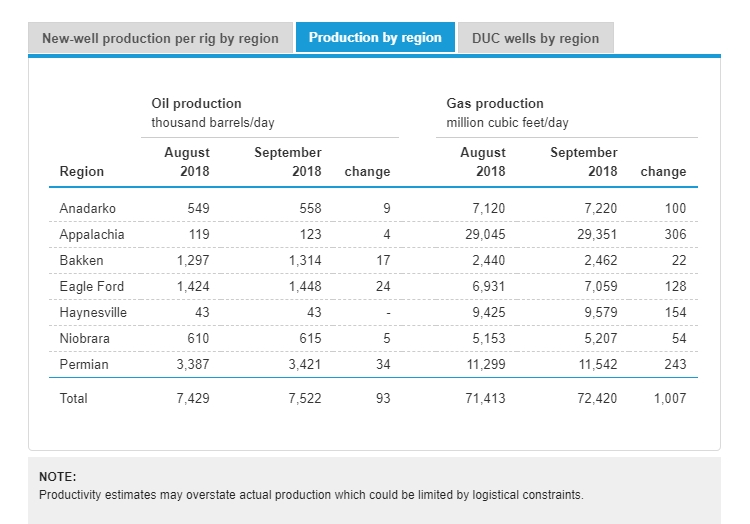

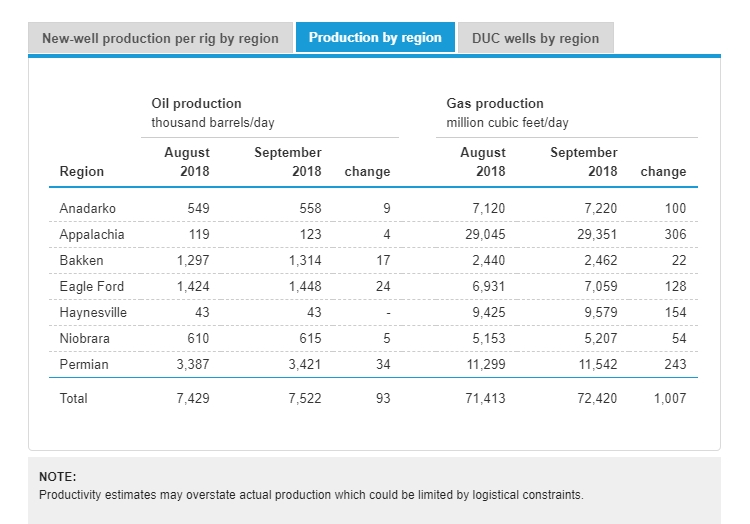

Notice that technology is changing very quickly, notice the rig count and the barrels per day per rig. technology in this field is expanding at a very quick pace.

The price to drill and operate these wells is dropping quickly. When the Saudis opened the valves to flood the world with cheap oil, it was their and the US Administrations goal to bankrupt the shale play. It backfired in ways that no one could have seen in late 2011. The costs to get the shale oil went from around $75 a barrel, same as the Alberta sands down to around $35 barrel today and the price keeps dropping.

So how much oil is produced in these wells? Its hundreds of barrels a day on average.

Bakken Formation

So what does this have to do with Zion Oil? Well I will get to that in a bit but for now I need to present my case.

Move over ExxonMobil, Chevron and ConocoPhillips—there's a new "Big Three" in U.S. energy production. And they're not companies.

In a new update to its drilling productivity report from last week, the Energy Information Agency said North Dakota's Bakken and Texas' Permian Basin and Eagle Ford Shale are quietly generating more than a million barrels of oil per day each–comprising at least a third of total U.S. daily oil production. Shale oil drilling generated the equivalent of nearly 90 percent of the U.S.'s total energy needs in 2013, according to EIA figures.

That 90%! Think about that a minute. Nearly 1/3 of US oil production is from just 3 shale formations!

"In all of human history, there have only been ten oil fields in the world that have ever reached the one million barrel per day milestone," the economist wrote in a recent blog post. "Three of those ten are now active in the US–thanks to the advanced drilling techniques that started accessing oceans of shale oil in Texas and North Dakota about five years ago.

It a revolution in technology that is changing the energy landscape around the world! I wonder where the other shale oil production is coming from?

Now a kicker is the following statement,

The average recovery factor of a typical well is 34 percent, Trammel said. "That tells you 2/3 of the oil is still in the ground," he said, adding that technological advances have helped boost productivity.

Elite oil fields redefine meaning of crude's 'Big Three'

That is huge!

Here is another article on the mighty Bakken formation.

The Mighty Bakken

To think that it was known in the 1950's but the technology did not exist. The very first oil well in North Dakota gave hints of what was to come 60 years later.

First North Dakota Oil Well

Here is another article that explains this transformation of oil drilling technologies that changed the face of oil production forever. Its a PDF so save it if you like.

Oil Production from the Bakken Formation: A Short History

As I asked earlier, if the big three are 1/3, then were are the others coming from?

What I was really after was the actual well production, and that is exactly what I found!

EIA.Gov - Drilling Productivity Report by Region

So what does this mean to Zion Oil and Israel? Well let's hold on a minute. Costs are very prohibitive to make a well commercial and I have shown above these costs are dropping very fast in the US but Israel is an unknown at this point.

In the US these well cost somewhere around $5-10 million on average but it is falling.

Speed is a second factor that is decreasing the cost of drilling. More efficient rigs and a more experienced labor force mean greater savings. The average time it takes to drill a well for Chesapeake Energy’s Powder River Basin Project dropped from 35 days to 14 in the last two years. The cost has plummeted from $4.5 million to $2.6 million. The average drill cost per foot was lowered from $245 to $143. That means drilling costs have been reduced for Chesapeake by about 42 percent, which offsets the drop in the commodity cost.

Other companies have reported cost reductions from 2014 to 2015. Bakken well costs dropped from $7.1 million to $5.9 million. Eagle Ford wells went from $7.6 million to $6.5 million. Marcellus wells were reduced from $6.6 million to $6.1 million. Midland Basin wells fell from $7.7 million to $7.2 million and Delaware Basin well costs were lowered from $6.6 million to $5.2 million.

Other companies have reported cost reductions from 2014 to 2015. Bakken well costs dropped from $7.1 million to $5.9 million. Eagle Ford wells went from $7.6 million to $6.5 million. Marcellus wells were reduced from $6.6 million to $6.1 million. Midland Basin wells fell from $7.7 million to $7.2 million and Delaware Basin well costs were lowered from $6.6 million to $5.2 million.

April 7, 2016

The Current Costs for Drilling a Shale Well

Also there is the possibility of re-fracking a well at 75% cost savings as the technology gets better.

Enter refracking. New wells can cost as much as $12 million a piece to drill while re-fracking the same well, utilizing the same piping, pumps and facilities, can cost $2 million, or less. And early results are showing that refracking is often obtaining more production from a three-year-old well than the well originally generated. Up until now, the oil producers were engaging in something called “The Red Queen,” referring to the character in Lewis Carroll’s Through the Looking-Glass, who tells Alice that in order to remain in place she must run faster

This technology, which some are calling Fracking 2.0, is not only reviving old wells, but it is also causing major rethinking about oil and gas as providing a source of increasing production even during times of declining prices. The traditional thinking goes like this: A marginal producer idles some of his rigs, hoping to cut expenses while waiting out the storm of declining prices, hoarding cash in the process. With enough marginal producers pulling back, so that thinking goes, production of gas and oil will fall far enough to bring supply and demand back into balance and make those marginal producers profitable once again.

Re-fracking Old Wells Is Extending the Fracking Revolution

I was reading the following article at lunch and decided I would dig into it when I get home and that is why this thread is here. I will continue to research it because it is important for not only the US but Israel as well.

As I have stated, the previous administration had done their best to kill the shale oil industry and without allowing new pipelines it got worse. There was nowhere to send the oil to without large costs. Mr. Buffet and his railroads were doing just fine however.

The current Midland to Cushing WTI spread stands around $16/b according to CME group—a historically high number. The future projections show the spread narrowing slowly in accordance with the planned pipeline extensions. The heavy Midland discount is an indicator that producers are using costlier transportation methods, like trains and trucks, to get the oil from where it is produced to where it is stored and refined.

Because new drilling has happened at an increasing rate, the rest of the infrastructure has yet to catch up. This number of drilled but uncompleted (DUC) wells are increasing, going from 2,621 in January 2018 to 3,470 in July, according to EIA data. The pipeline capacity out of the Permian basin is becoming fully utilized with no spare capacity available to handle increasing production. Other means of transportation, by rail for example, are being employed, but are more cumbersome and expensive.

We now are building the pipelines and infrastructure we need to get the oil out and to market. The Keystone pipeline being one big one that the previous Administration kept stopping. Yes it was mainly for the Tar Sands but passed right through the Williston Basin as well.

The type of wells is also changing rather quickly, lateral wells are becoming the norm.

The well potential, weighted by lateral length, has also increased significantly during the expansion period but was less affected by the price crash. Wells were producing 42 barrels per day per thousand feet in 2013, and are currently more than double that after reaching a peak of 128 in September 2017, according to Kayrros data. The increase in efficiency per well has clearly shown that horizontal wells have become more productive over time.

August 30, 2018

Production Growth In The Permian To Hit New Record

So again, what does this have to do with Zion Oil? Well we are almost there..

Energy geologists estimate that billions of barrels of crude oil are available in shale in the occupied Golan Heights, but will Israel be able to get to it? If it can, the field could make the Jewish state self-sufficient in oil for years.

Major Shale Find Could Guarantee Israel’s Oil Supply For Years

Notice what the article title is? Yeah that is starting to make sense now.

So far, Afek has drilled three times into the Golan shale and reported finding huge reserves of crude that could easily meet Israel’s demand for fuel for a long time. The country now uses about 270,000 barrels of oil every day.

But exactly how much oil is trapped in the rock isn’t yet known. One unknown is whether extracting the crude would be profitable, given the relatively high cost of shale extraction, usually by hydraulic fracturing, or fracking, at a time when oil prices remain stubbornly low.

Notice where Genie drilled? MJ#1 location?

Why stop and go away? Environmentalists I think are playing a part in it as well as politics.

The newly found reserve is not without controversy. Numerous environmental groups and residents of the Golan Heights are bitterly opposed to the drilling, expressing fears that it could damage the region’s landscape. When Afek first began exploration in the area late last year, environmentalists filed a petition against drilling that ultimately reached the High Court of Justice.

The international community considers the Golan Heights occupied territory, further complicating oil production. Much of the Golan Heights was captured from Syria during the war in 1967, and Israel’s sovereignty over the region remains contested.

The international community considers the Golan Heights occupied territory, further complicating oil production. Much of the Golan Heights was captured from Syria during the war in 1967, and Israel’s sovereignty over the region remains contested.

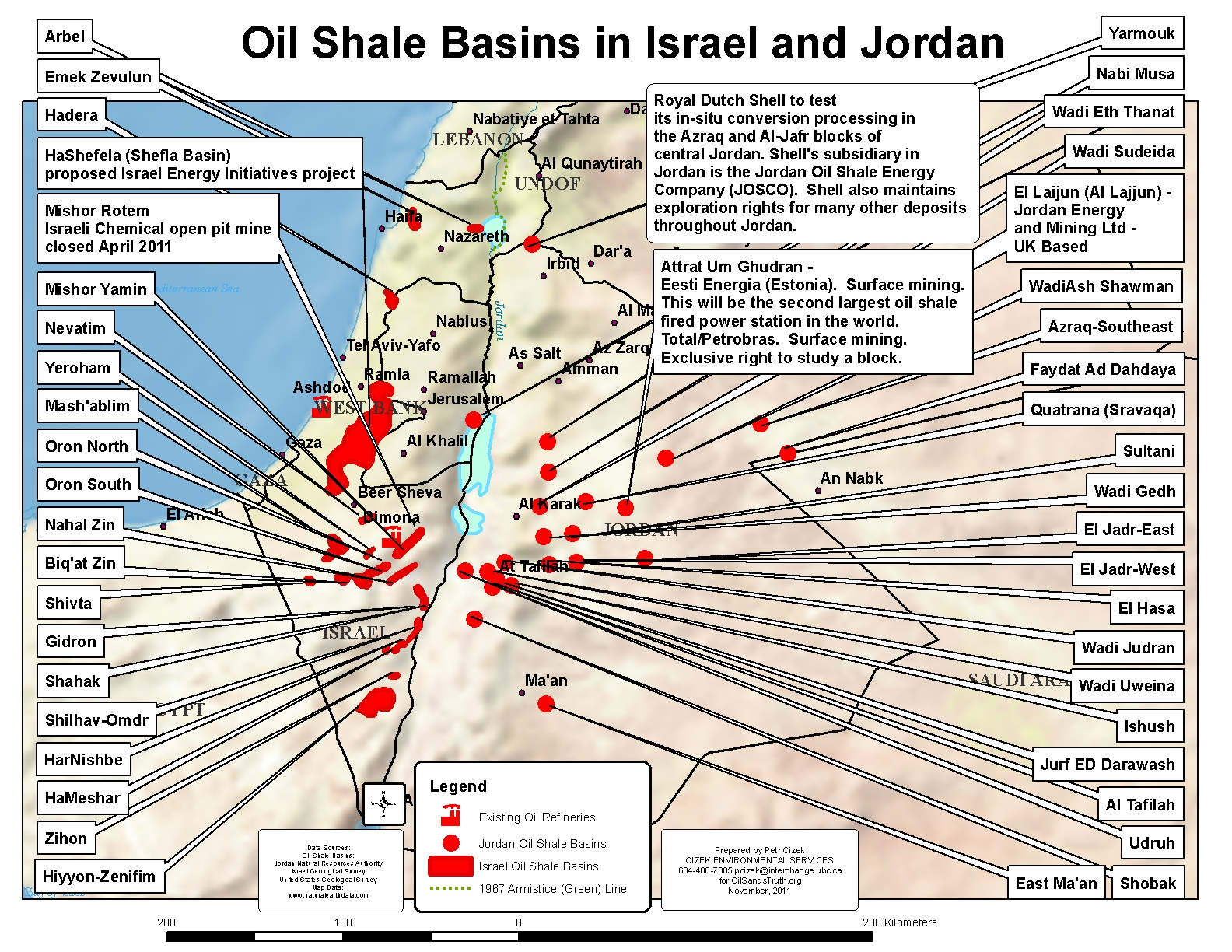

Oil Shales in Israel

And here is Genie again, right in the middle of it.

In November, 2010, an 11% stake in Genie Oil & Gas, the division of IDC that is the parent company of IEI, was acquired for $US11m by Jacob Rothschild, the banker, and Rupert Murdoch, chairman of News Corporation and promoter of right-wing lunacy throughout the English-speaking world.

Genie's advisory board includes impressive figures such as Michael Steinhardt, the hedge fund investor, and more frightening ones, like Dick Cheney, former US vice-president, and co-founder of the Shiite Islamic Republic of Iraq, along with his running buddy George W Bush.

Genie's advisory board includes impressive figures such as Michael Steinhardt, the hedge fund investor, and more frightening ones, like Dick Cheney, former US vice-president, and co-founder of the Shiite Islamic Republic of Iraq, along with his running buddy George W Bush.

Is Israel The Saudi Arabia Of Shale Oil?

Israel / Palestine Shale Oil

Production (current): 0 barrels per day

Production (projected): 200,000 barrels per day

Deposits (in place): 2,000.00 billion barrels

Deposits (recoverable): 250.00 billion barrels

Production (projected): 200,000 barrels per day

Deposits (in place): 2,000.00 billion barrels

Deposits (recoverable): 250.00 billion barrels

250 bn bbl (perhaps more) estimated recoverable across the entire territory inside of the so-called Green Line. Small amounts of potential oil also exist inside the West Bank.

This is not just an Israeli thing, its all over folks!

Oil Shale is a well-known deposit from early geological research and is distributed worldwide. Some of the better known Oil Shale deposits are the richer ones. These are found in the USA, China, Russia, Brazil, Australia, Estonia, Scotland, Germany, the Middle East and many other locations. The richest oil shale has an organic content reaching up to 30%+.

In the Middle East vast deposits of Oil Shale occurs in Jordan, Syria, Lebanon and Israel. They are of Upper Cretaceous (mostly Maastrichtian) age, fairly rich and relatively widespread and thick.

In the Middle East vast deposits of Oil Shale occurs in Jordan, Syria, Lebanon and Israel. They are of Upper Cretaceous (mostly Maastrichtian) age, fairly rich and relatively widespread and thick.

World distribution of Oil Shale

So finally I get to my point. What if Zion has hit a formation deep in the Triassic with low permeability but with large amounts of oil in place but it is not conventional? What would be the the percentage recoverable and with what technology? What if this testing is just that, getting a good feel for how to get the oil out. Givot did it, so there is history already in place. Genie, while shallower, also hit massive amounts of oil but claimed it was not economical to get to out just as North Dakota was in 1950. Technology is changing so fast that this remains a serious possibility.

MJ#1 sure was not a blowout like a spindle top, but something is amiss somewhere. How can they be testing this long if it does not naturally flow? What are they doing to entice it to flow? What is it that they know and are not telling anyone yet? I would think with Zion's previous record and their great relationship with the Israeli petroleum commission, they might be doing just that. I mean they could not announce it at this point as the Environmentalists will go crazy as this is not the Golan, the political situation is far different.

In 2015, an independent study by the international consulting company Beicip-Franlab concluded that up to 6.6 billion barrels of oil (in-place best estimate) remain to be found in Israel’s Levant Basin. Zion’s Megiddo-Jezreel License area is entirely within the Levant Basin and is well positioned to encounter the key geologic ingredients of an active petroleum system.

Levant Basin Reserves